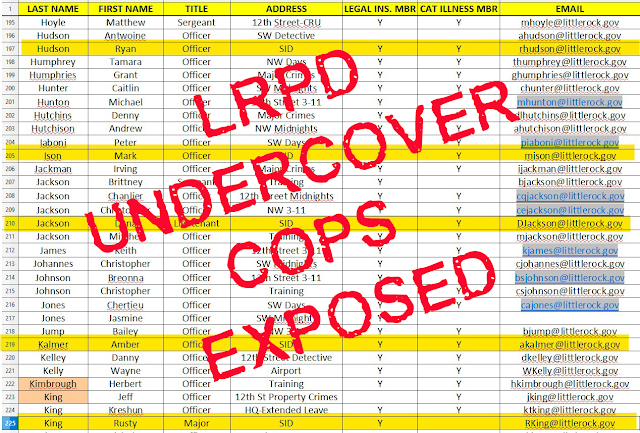

Little Rock Fraternal Order of Police identifies and exposed all the LRPD undercover cops on their website

|

| LRFOP exposed all LRPD undercover cops in a spreadsheet they posted |

The Little Rock Fraternal Order of Police posted a spreadsheet on their website of all LRFOP members that identified and exposed all LRPD cops that are reportedly working in an undercover capacity in the Special Investigations Division ("SID").

We found that publicly posted document while working on a complaint about four LRPD cops, all LRFOP board members, that appeared in a political campaign advertisement that endorsed a candidate for a state office in violation of LRPD Rules & Regulations.

LRPD Rules & Regulations prohibit LRPD cops from doing that.

The LRPD cops that run the LRFOP are poster children that exemplify that fact that you can be too smart to be a cop.

Another "undercover" LRPD cop, Raymond Koonce, posts his contact information on Facebook and Twitter in posts objection to Little Rock business owner's application for an alcoholic beverage permit.

When you call that number and if the call goes to voicemail you get this message.

It clearly states that the telephone number is for Raymond Koonce. Why would an "undercover" cop, post his phone number and have his name on the voicemail?

Koonce frequently appears at public meeting and identifies himself as an "undercover" cop. We found that out back in 2018 when we reported on LRPD take-home vehicles.

Another LRPD "undercover" cop, Mark Ison, yes the same one listed on the LRFOP page as being their Sergeant-at-Arms...

The LRPD cops that are assigned as bodyguard for the feckless LR mayor are also classified as "undercover" cops, yet you see them with him at public appearances and acting as his chauffeurs.

###

The LRFOP has another big problem. A really big one involving their LRFOP Foundation.

Little Rock Fraternal Order of Police (LRFOP) has SERIOUS violations of their Federal 501(c)(3) status.

What Does "Participating in a Political Campaign" Mean?

Organizations with 501(c)(3) status cannot participate in political campaigns.

What is a political campaign? In general, the IRS rule refers to campaigns between people who are running for offices in public elections. These can include: candidates running for president of the U.S.; candidates running for governor; candidates running for mayor; and also candidates for lower elected offices such as school board officials, city supervisors, and county trustees.

What is "participating?" Your organization cannot participate in a campaign, directly or indirectly, on behalf of or in opposition to a candidate. If your organization takes a stand in any campaign, supporting or opposing one or another candidate, this violates the prohibition.

The IRS Rule

The IRS uses what is called a "facts and circumstances" test to help it determine whether an organization has violated the prohibition on political campaigning. This means that the IRS will evaluate any potential misconduct within the context of the organization's other activities and the current political climate. So, an activity might be considered political campaigning two weeks before an election, but not two years before an election.

Some activities that the IRS has found to violate the prohibition on political campaigning include:

--inviting a political candidate to make a campaign speech at an event hosted by the organization

--using the organization's funds to publish materials that support (or oppose) a candidate

--donating money from the organization to a political candidate

--any statements by the organization's executive director, in his or her official capacity, that support a candidate

--criticizing or supporting a candidate on the organization's website

--inviting one candidate to speak at a well-publicized and well-attended event, and inviting the other candidate to speak at a lesser function

--inviting all candidates to speak at an event, but arranging the speaking event or choosing the questions in such a way that it is obvious that the organization favors one candidate over the others

--conducting a "get out the vote" telephone drive in a partisan manner by selecting caller responses for further follow-up based on candidate preference, and

--using the organization's website to link to only one candidate's profile.

What Political Activities Can a 501(c)(3) Nonprofit Engage In?

A 501(c)(3) organization can engage in the following activities without violating the IRS rule:

Non-partisan activities. Your organization may engage in non-partisan activities such as non-partisan voter registration drives, non-partisan candidate debates, and non-partisan voter education, as long as these activities fulfill your exempt purposes.

Legislative or issue advocacy. Your organization can engage in legislative advocacy and issue-related advocacy, as long as it follows certain rules and steers clear of political campaigning. (If your organization is contemplating such activities, it's a good idea to get advice from a qualified attorney.)

And don't forget that any individuals associated with a 501(c)(3) organization are entitled to voice their opinions and participate in a political campaign, as long as they are not speaking for the organization.

How Does the IRS Find Out About Violations?

Not surprisingly, in the heated atmosphere that usually accompanies a political campaign, people supporting an opposing candidate are often the ones to report any suspicious activities to the IRS. Your organization should remember that people are watching and they will report your group if you appear to intervene in a political campaign in a partisan manner.

Penalties For Violations

If the IRS believes that your organization may have violated the prohibition, it may send a letter or visit your organization for an on-site examination. Although the IRS has the power to revoke your tax-exempt status, it typically uses this punishment only in the most egregious cases. More likely, the IRS will ask your organization to correct the violation and implement procedures to make sure the violation will not occur again. If the organization's funds were used to engage in the prohibited activity, the IRS may also impose excise taxes.

Can a section 501(c)(3) organization state its position on public policy issues that candidates for public office are divided on?

An organization may take positions on public policy issues, including issues that divide candidates in an election for public office as long as the message does not in any way favor or oppose a candidate. Be aware that the message does not need to identify the candidate by name to be prohibited political campaign activity.

A message that shows a picture of a candidate, refers to a candidate’s political party affiliations, or contains other distinctive features of a candidate’s platform or biography may be prohibited political campaign activity.